Renters Insurance in and around Denver

Denver renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

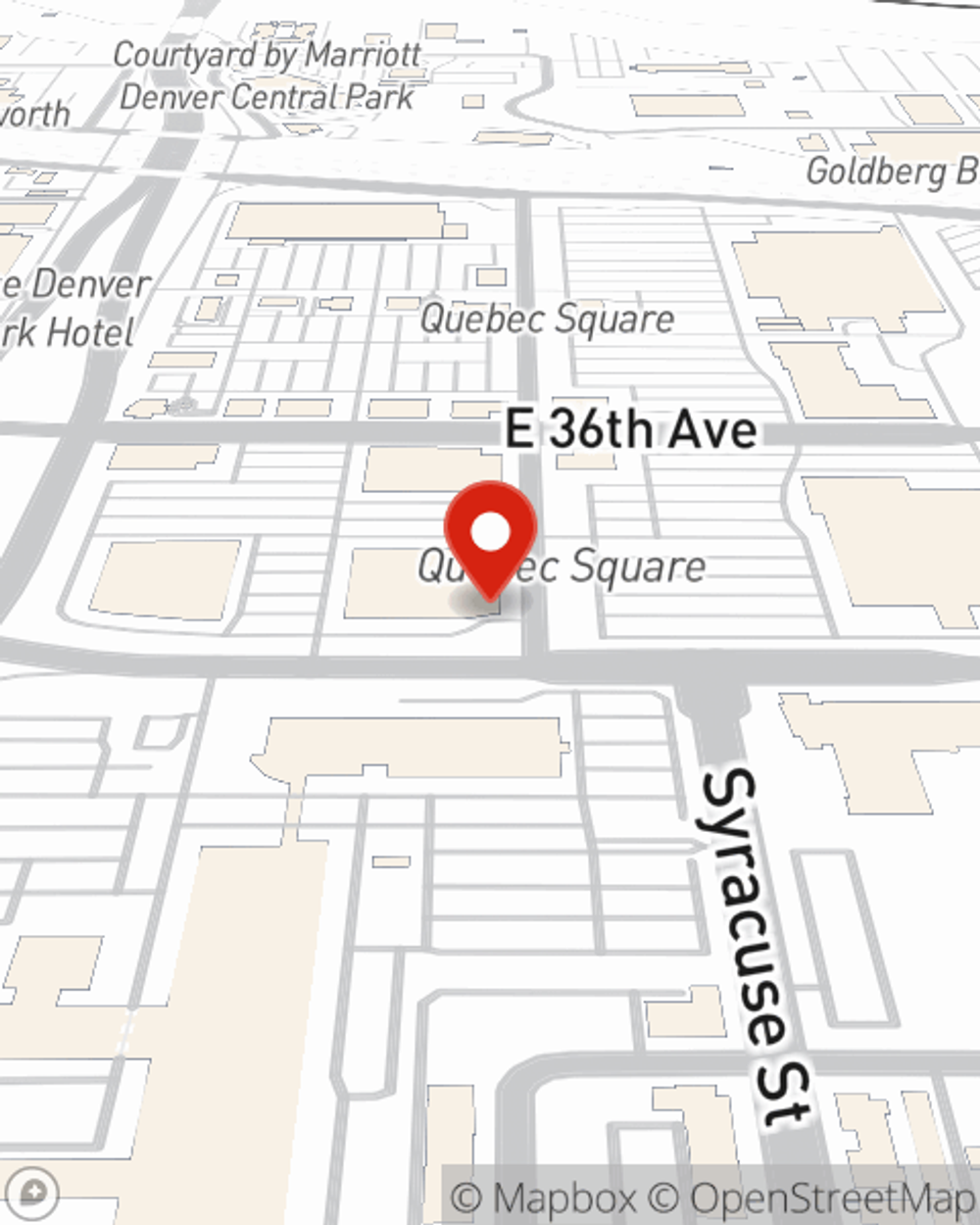

- Central Park

- Aurora

- Commerce City

- Northfield

- East Bridge

- Denver

- Park Hill

- Green Valley Ranch

- Montbello

- Lowery

- Glendale

- 80238

Insure What You Own While You Lease A Home

There are plenty of choices for renters insurance in Denver. Sorting through deductibles and savings options to pick the right one isn’t easy. But if you want budget-friendly renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy impressive value and hassle-free service by working with State Farm Agent Kenny Plank. That’s because Kenny Plank can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including jewelry, tools, souvenirs, home gadgets, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent Kenny Plank can be there to help whenever the unexpected happens, to get you back in your routine. State Farm provides you with insurance protection and is here to help!

Denver renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Agent Kenny Plank, At Your Service

Renters often raise the question: Is renters insurance really necessary? Think for a moment about what would happen if you had to replace your valuables, or even just a few of your high-value items. With a State Farm renters policy in your corner, you don't have to be afraid of abrupt water damage from a ruptured pipe. Renters insurance doesn't stop there! It extends beyond your rental space, covering personal items you've secured in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. As more of your life is online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Kenny Plank can help you add identity theft coverage with monitoring alerts and providing support.

If you're looking for a value-driven provider that can help with all your renters insurance needs, visit State Farm agent Kenny Plank today.

Have More Questions About Renters Insurance?

Call Kenny at (303) 377-1757 or visit our FAQ page.

Simple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Kenny Plank

State Farm® Insurance AgentSimple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.